PH Pag-IBIG HQP-SLF-002 2012-2025 free printable template

Show details

HQP-SLF-002. CALAMITY LOAN. APPLICATION FORM (CLAN). (To be filled out by applicant. Print this form back to back on one single sheet of paper). Type or ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign education loan in pag ibig form

Edit your pag ibig loan form 2025 pdf download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calamity loan form pag ibig 2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pag ibig calamity loan form 2025 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pag ibig calamity loan form 2025 pdf download. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH Pag-IBIG HQP-SLF-002 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pag ibig calamity loan 2025 form

How to fill out PH Pag-IBIG HQP-SLF-002

01

Obtain the PH Pag-IBIG HQP-SLF-002 form from the official Pag-IBIG website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information in the designated fields, including your full name, address, and Pag-IBIG membership ID.

04

Provide details regarding your employment status, including your employer's name and contact information.

05

Indicate the purpose of the application clearly on the form.

06

Attach any necessary supporting documents as specified in the instructions.

07

Review all the information entered for accuracy and completeness.

08

Sign and date the form at the bottom to certify that the information provided is true.

09

Submit the completed form and the required documents to your nearest Pag-IBIG office or through the designated submission channel.

Who needs PH Pag-IBIG HQP-SLF-002?

01

Individuals applying for loans or benefits under the Pag-IBIG Fund.

02

Members of Pag-IBIG seeking to access housing finance options.

03

Employees looking to avail of the Pag-IBIG services related to housing loans.

Fill

pag ibig loan form 2025

: Try Risk Free

People Also Ask about pag ibig salary loan form 2025

How many years before you can loan in Pag-ibig?

Eligible to apply for Pag-IBIG Fund MPL: Only the preceding six (6) monthly contributions immediately prior to loan application must be successively paid. Note: An “active member” is one who must have paid at least six (6) consecutive monthly contributions prior to the date of loan application.

How many percent is Pag-IBIG loan?

A member can borrow up to 80% of their Pag-IBIG Regular Savings, and can be processed in as fast as 2 days! Read more below and learn how to secure cash through the Pag-IBIG Multi-Purpose Loan.

What are the types of loan in Pag-Ibig?

Housing Loan. Pag-IBIG Home Equity Appreciation Loan (HEAL) Virtual Pag-IBIG. For Developers. Membership. Kasambahay Membership Registration. Housing Loan Payment Viewer. Housing Loan Online Application. Application for Housing Loan Interest Repricing. FAQs. Multi-Purpose Loan. Pag-IBIG Home Equity Appreciation Loan (HEAL) Forms.

How can I calculate my Pag-IBIG loan amount?

Your loanable amount will be the difference between your current loan balance and 80% of your contribution's Total Accumulated Value (TAV).

Can I loan in Pag-IBIG if I have an existing loan?

YES. A qualified Pag-IBIG member who has an existing housing loan may avail himself of an additional housing loan for the following purposes: a lot purchased/refinanced through a Pag-IBIG housing loan; Home improvement; or.

What are the requirements to loan in Pag-Ibig?

Before getting started, please make sure to prepare the following: LOAN APPLICATION FORM. Photo or scanned copy of your LOAN APPLICATION FORM, containing the required information, your signature, the signature of your employer (if employed) and signature of two (2) witnesses. ONE (1) VALID ID. CASH CARD. SELFIE PHOTO.

How is loanable amount calculated in Pag-IBIG housing?

ing to Pag-IBIG, you can only borrow up to an amount with a monthly amortization of at most 35% of your gross monthly income. If you wish to repay your ₱500,000 loan for a repayment period of 30 years at a 10% interest rate, you should be earning a gross monthly income of at least ₱12,536.74 to qualify.

How much is the loanable amount in Pag-Ibig?

The Pag-IBIG Fund Housing Loan allows you to borrow up to P6 million under very low rates and at the friendliest terms, to help you fulfill your dream of owning a home!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pag ibig form 2025 pdf download online?

The editing procedure is simple with pdfFiller. Open your claf pag ibig form 2025 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I edit updated pag ibig loan form 2025 pdf download on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit pag ibig salary loan form pdf download.

How do I edit pag ibig salary loan form 2025 pdf download on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute pag ibig loan form 2025 online from anywhere with an internet connection. Take use of the app's mobile capabilities.

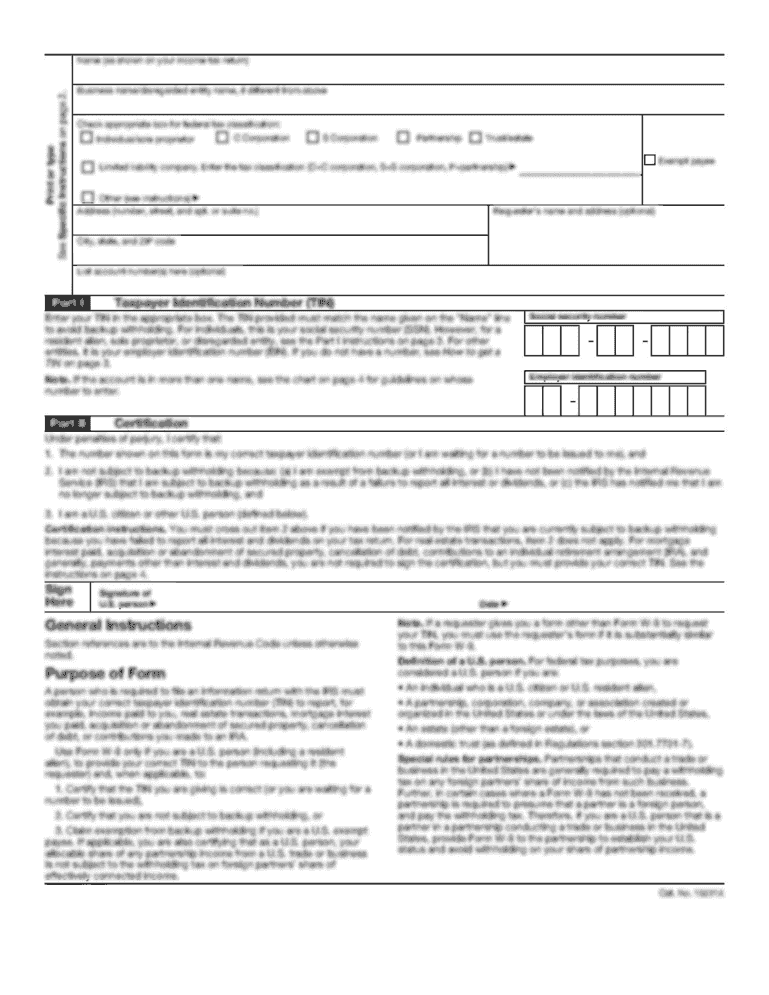

What is PH Pag-IBIG HQP-SLF-002?

PH Pag-IBIG HQP-SLF-002 is a document or form used by employers to report and submit contributions to the Pag-IBIG Fund, which is a savings program designed to provide employees with access to affordable housing loans and other financial benefits.

Who is required to file PH Pag-IBIG HQP-SLF-002?

All employers in the Philippines who have employees that are Pag-IBIG members are required to file PH Pag-IBIG HQP-SLF-002 to accurately report their employees' contributions.

How to fill out PH Pag-IBIG HQP-SLF-002?

To fill out PH Pag-IBIG HQP-SLF-002, employers need to provide information such as their company details, employee details, contribution amounts, and other relevant information as specified in the form. Clear instructions are usually included with the form.

What is the purpose of PH Pag-IBIG HQP-SLF-002?

The purpose of PH Pag-IBIG HQP-SLF-002 is to ensure that employers properly report their employees' contributions to the Pag-IBIG Fund, enabling them to access benefits such as housing loans and savings programs.

What information must be reported on PH Pag-IBIG HQP-SLF-002?

The information that must be reported on PH Pag-IBIG HQP-SLF-002 includes the employer's details, the names and contributions of all employees, the total contributions for the period, and any other data required by the Pag-IBIG Fund.

Fill out your PH Pag-IBIG HQP-SLF-002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pag Ibig Educational Loan is not the form you're looking for?Search for another form here.

Keywords relevant to pag ibig claf form 2025

Related to claf pag ibig form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.